“It would be so nice if something made sense for a change.”

—Lewis Carroll, “Alice in Wonderland”

August didn’t begin so well, as the S&P 500 pulled back about 4.5% through the first three weeks of the month, but it rallied in the final few days to make for a “much ado about nothing,” virtual flat-return-type of month.1 With this large-cap index having surged more than 27% off its October 2022 low and posting a nearly 19% return year to date going through the month,2 many were suggesting that investors should not get complacent.

Believe me, we agree with this thought. We had no impulse to relax and take a victory lap due to the S&P 500 hitting our 4,500 year-end 2023 target several months in advance of that date. We are pleased that we have gotten the positive trend correct so far this year and that we encouraged clients not to get uber-negative in 2023 as many experts and the headlines seemed to be throughout the year’s recovery rally.

Growth Outpaces Value, but Balance Is Key

We are also gratified that we have delivered a strong message not to abandon growth stocks in 2023 and run solely to “safe” value stocks as many urged going into the year. August was simply another month when technology stocks and other growth-oriented sectors well outperformed value, adding to growth’s substantial lead over value stocks this year.

Balance between the two continues to be our mantra, and the strong fundamentals exhibited by a number of stocks in both of these camps is a key reason why we look for higher highs in 2024. Specifically, we have set an updated target of 4,800 to 5,000 for the S&P 500 by midyear next year. We do not believe the stock market’s advance this year is a sugar high or that it is based on false precepts. Importantly, the economy and earnings have been far stronger than the bear camp predicted, and inflation has continued to calm. The latter is a key ingredient in the Federal Reserve’s ability to finally back off its rate-hike campaign in the not-too-distant future.

New Wall of Worry Items Won’t Derail Market

All this said, there are ample reasons to envision a pause or 10% to 15% pullback after the market’s hard run before we get to that 4,800 to 5,000 “promised land” that we anticipate in 2024. Profit taking is quite normal following an advance like this, and there are a couple of new wall of worry items surfacing that are bound to feed negative headlines and cause some temporary angst. These include rising 10-year Treasury yields, seasonality concerns as we head into early fall and economic headwinds in China. We’ll touch on several of these in just a moment.

Like other wall of worry items that have confronted the market these past few years, we believe these issues will be adequately managed and won’t derail the constructive fundamental catalysts driving the market, but they could cause investors to wring their hands for a quarter or so and cause some price-to-earnings multiple contraction for a bit before it becomes clear that worst-case fears are unwarranted. Think banking crisis and debt ceiling debates earlier this year that escaped worst-case outcomes but caused temporary swoons.

Near-Term Risks Emerge

Going into 2023, valuation multiples had declined, fundamentals looked unappreciated, and investors were uber-bearish… a contrarian positive. As a result, we thought the risks were to the upside, and we established the profitable targets we currently have for the stock market. Today, we maintain these profitable targets for the intermediate/longer term (six to 12 months). However, we believe near-term downside risks exist and are driven by these factors: sentiment that has shifted to a far more bullish posture, fewer people believing we still could see a mild recession and a temporarily overbought market. In addition, a few new wall of worry items are just now being discussed by investors and the media.

Bottom line, in this environment we maintain our hold your ground, measured and balanced view. Maintain your long-term targeted asset allocation target for stocks (not more than or less than normal) and embrace active management to perform well in what could be choppy waters through year-end.

No Time for Complacency

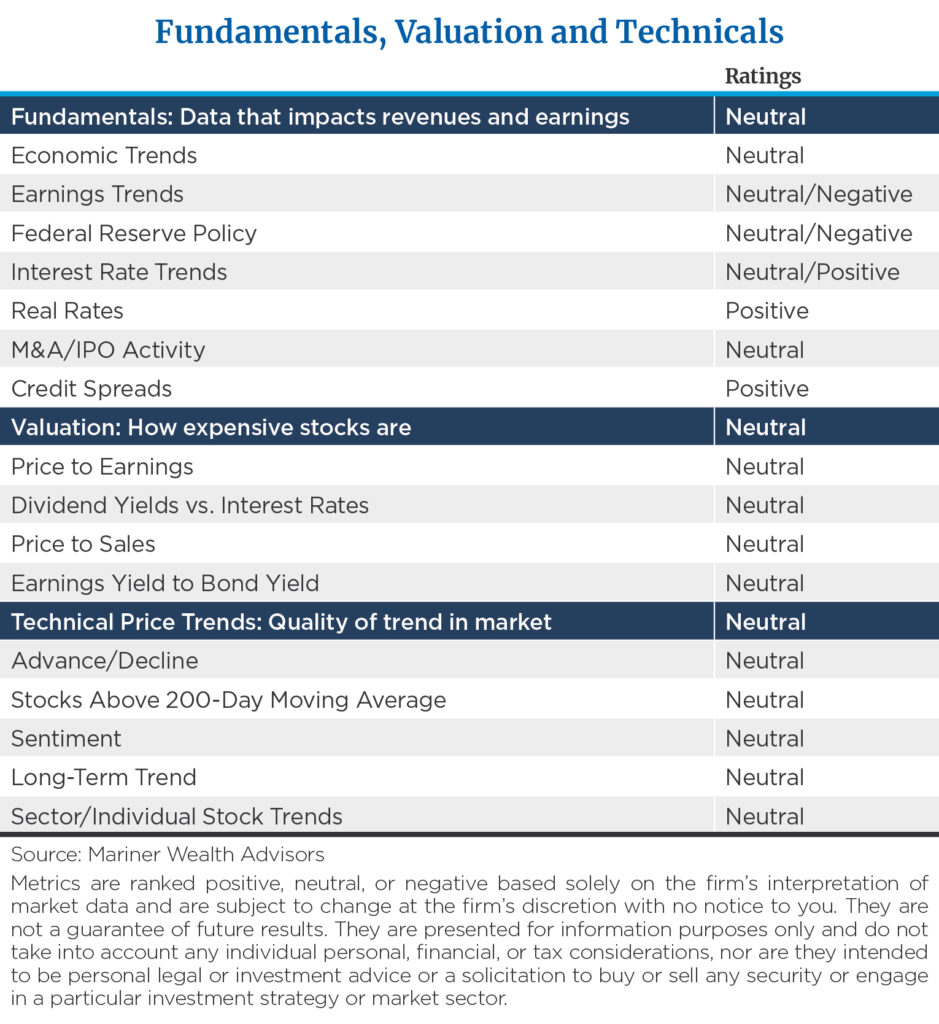

We remain constructive on the market’s direction and trend looking out through mid- and late 2024, but we are not whistling past the graveyard after this rally or content in all things. Maintaining a generally positive outlook this year seems to be a lightning rod for questions/comments from skeptics that such a view is naïve and ignores the risks embedded in the capital markets over the last 12 to 18 months as well as in the upcoming 12 to 18 months. We disagree. We are respectful of risk. We are measured in our outlook that is driven by the facts… a fundamental, valuation and technical (FVT) backdrop that is stronger than anticipated by most and overall neutral in tenor—as it usually is!

“Seasonality Risk” Is Mixed

The new items on investors’ list of things to worry about more recently include seasonality. September is the worst month for returns in the stock market. This is true. Going back to 1928, 56% of the time S&P 500 price returns are negative in September, with an average monthly price return of roughly -1.4%. The month of September is also associated with such tragic events as 9/11 and Lehman Brothers’ failure. September has been a negative-return month the last three consecutive years, but as in all things market related, perspective is needed here. All is not lost.

September is positive 44% of the time, and when it is a profitable month, it is handsomely so, generating average monthly returns of over 3.4% in those positive periods.3 Per Barron’s, the last time September had three consecutive negative showings (2014 to 2016), it was followed by a 3-year winning streak. Here’s another nice stat for superstitious investors: Barron’s also recently noted that when the S&P 500 gains between 10% and 20% through August (as it has this year), historically it has advanced 7.6% in the final four months.4 We don’t put any credence in any predictive value of this data, but it does demonstrate that the “seasonality” risk is mixed or potentially unfounded. Not much to worry about on this front with any certainty!

Rising Treasury Yields Should Stabilize

Ten-year yields on government bonds have somewhat quietly risen to their highest levels since 2007. Specifically, they have advanced more than 1% from their low in April in the aftermath of the run on Silicon Valley Bank’s deposits and its failure. They have stabilized recently after peaking at 4.3% in mid-August.5 The fear, though, is that if they rise further to the 5% to 6% level, they will become intimidating competition to stocks and cause significant price-to-earnings multiple contraction as well as perhaps inspire an equally stomach-churning recession.

Our base case calls for rates to stabilize right around current levels, perhaps just a bit higher or lower, but not much so. We have good reason to maintain this view. The Fed appears to be winning in its attempt to lower inflation. The core inflation figure that the Fed follows closely has declined to an annualized rate of 2.9% according to data over the last three months, and the headline goods inflation rate now is running at a -0.5% year-over-year rate, per data in July.6 Wage inflation also fell to a monthly rate of 0.2% in August, a sign of easing in the labor market that is so front and center for the Fed.7 One month does not make a trend, but figures are moving in a more comfortable direction.

Bad News Is Really Good News

On a related note, the market ironically cheered the softer news on the employment front in August. It was thrilled that monthly payroll growth slowed to the 187,000 new jobs level in August from the year-to-date monthly level of well over 200,000, that the previous two months’ payroll growth figures were revised downward by a significant 110,000 jobs and that the unemployment rate spiked up from 3.5% to 3.8%.8 I know it sounds Alice in Wonderland-like that folks cheer weaker job creation in the market, and such reactions feel rather nonsensical. “Yay, fewer people found jobs this month—let’s celebrate!” Somehow that logic is just strange, right? Hence our quote at the beginning of this commentary.

The sense we can make out of this, however, is that the Fed and market followers are looking for some signs of loosening in the tight labor market, and this news was Goldilocks in nature. We would point out that jobs still did grow at a healthy rate, and the only reason the unemployment rate rose to 3.8% was that more folks entered the labor force. The labor force grew by nearly 740,000 as new people began to look for work, which is a good sign of an increasing supply of workers.9 Something we’ve been hoping to see. So, in this case, “bad news really is good news” in an Alice in Wonderland sort of way.

Our conclusion on this point is that a rising supply of labor and other signs of easing in the labor market and inflation should allow the Fed to pause within a reasonable time frame and perhaps ease over the next 12 months. This in turn should enable longer rates to stabilize at these higher, yet arguably more comfortable, levels.

Even the Fed’s summary of economic projections reveals that the committee members themselves expect the Fed to gradually reduce the federal funds rate by the end of 2024 and for inflation to calm to the 2.5% level as we move into 2025. That does not describe a harsh rise in rates type of scenario to us. Interestingly, this is also the consensus view of economists. The counterargument of more bearish folks, who believe 10-year yields could quickly rise to as high as 6%, is that our federal deficit is exploding, and inflation is bound to reaccelerate. We try not to predict the predictors but instead monitor and follow the data. It is hard to embrace such an unproductive outlook based on the trend in the facts at an aggregate level at present.

Wrap-Up

A measured message to remain neutral and balanced in your portfolio and overall allocation may sound boring and doesn’t sell a lot of newspapers. But we believe it’s an appropriate and effective strategy and tone right now. The FVTs are neutral, and therefore so are we.

On the individual stock front in our internally managed strategies, we still find a number of stocks with good earnings prospects that are fairly to attractively priced. Even the so-called “Mega Eight” get a bad wrap for valuation and their exaggerated strong performance so far this year. We might agree on this latter point to some degree, but there are a lot of stocks other than these limited eight that one can own. In addition, have you checked out the Mega Eights’ earnings? They’re pretty impressive as well. Stay tuned, and thanks for your confidence and the privilege to serve you.

Footnotes:

1-3FactSet

5FactSet

6Bureau of Economic Analysis

7-9Bureau of Labor Statistics

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation. The indexes are unmanaged and cannot be directly invested into. Past performance does not guarantee future results. Investing involves risk and the potential to lose principal.

This commentary is for informational and educational purposes only and is limited to the dissemination of general information pertaining to general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but we do not warrant the accuracy of the information that any opinion or forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.

Mariner Advisor Network is a brand utilized by Mariner Independent Advisor Network (“MIAN”) and Mariner Platform Solutions (“MPS”). Investment advisory services are offered through Investment Adviser Representatives registered with MIAN or MPS, each an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. MIAN and MPS comply with the current notice filing requirements imposed upon registered investment advisers by those states where they transact business and maintain clients. MIAN and MPS have either filed notice or qualify for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MIAN or MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For information about which firm your advisor is registered with, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided by your advisor.

Investment Adviser Representatives are independent contractors of MPS or MIAN and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS or MIAN and is not registered with the SEC. Please refer to the disclosure statement of MPS or MIAN for additional information.